Tax Filling Deadline is Coming July 15

Don't forget - tax day is coming.

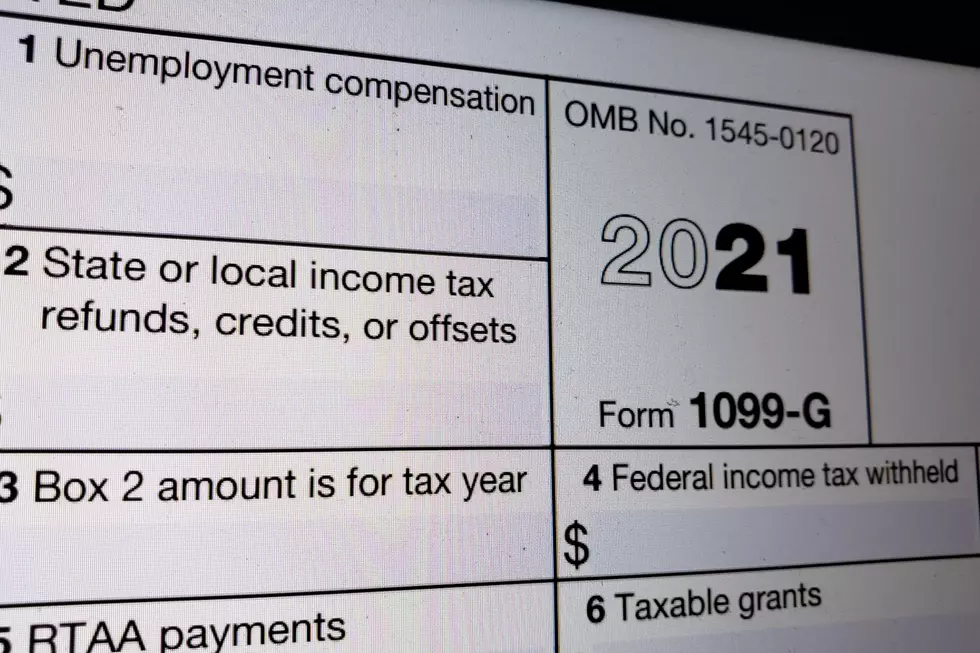

The COVID-19 pandemic hit the U.S. in the spring and caused the world to shut down. The federal government postponed our usual tax day, April 15, to July 15, and that day is rapidly approaching.

That certainly helped those individuals and businesses who may have had to pay this year and gave them a break till the new deadline of July 15.

You may also file an extension, but you should do so before the July 15 deadline or you may face a penalty.

So for those people who are still waiting to file or need to make a payment, KCEN has posted some answers to those questions.

Let's start with YES. You must file and pay your taxes by the July 15 deadline. If you need to, you can file for an extension till Oct. 15 and that can be done on the IRS website.

If you can't pay your taxes on time, you should still file. The IRS will work with you on payments, and keep in mind the failure to file is more expensive than the failure to pay.

Doing your own taxes can be a little time consuming and sometimes hard to figure out, but there are plenty of online sites to help you with the process. Most of those sites do cost some money so keep that in mind.

CHECK IT OUT: How To Unlock Your iPhone With Your Voice

More From KTEM-AM